New Registration Regime for Dealers in Precious Metals and Stones Act Now for Any Transaction(s) with Total Value at or above HKD120,000!

2023-05-31

Hong Kong is one of the world’s freest economies and most advanced international financial centres. Despite enjoying the robust business environment and convenient capital flow, these advantages also come with the risk of money laundering and terrorist financing activities. At the end of last year, the Customs and Excise Department successfully uncovered a suspected money laundering case of approximately HKD3.5 billion and involving trading of precious metals. Hence, we should not overlook the risk of money laundering by criminals through the trading of precious metals and stones.

To enable Hong Kong to align with international standards in combating money laundering and terrorist financing and reinforce its position as an international financial centre, the Government has introduced a new registration regime for dealers in precious metals and stones since 1 April 2023. Under the regime, any person who is seeking to carry on a business of dealing in precious metals and stones in Hong Kong and engage in any transaction(s) (whether making or receiving a payment) with total value at or above HKD120,000 in Hong Kong, is required to register as either Category A or Category B registrant.

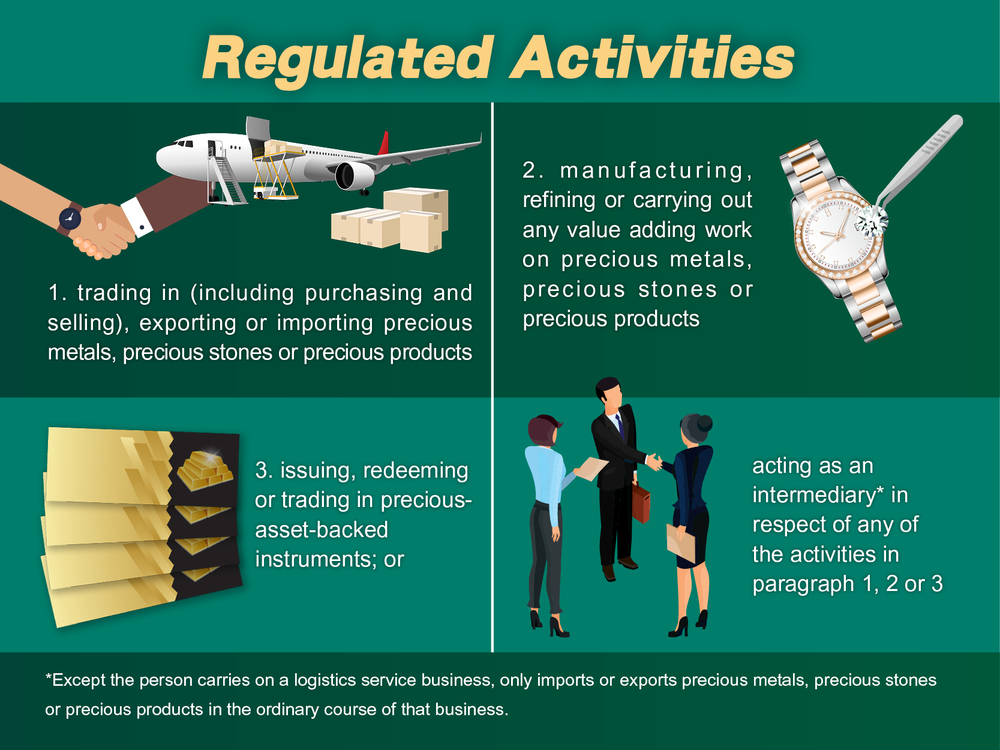

Be Mindful of the Wide Range of the Regulated Activities and Articles

The regulated articles under the registration regime are not limited to precious metals and stones but also include precious products and precious-asset-backed instruments. Details are as follows:

2. Precious stone: diamond, sapphire, ruby, emerald, jade or pearl, whether natural or otherwise;

3. Precious product: any jewellery or watch that is made up of, containing or having attached to it, any precious metal or precious stone, or both;

4. Precious-asset-backed instrument: any certificate or instrument backed by one or more precious metals, precious stones or precious products that entitles the holder to such assets (in entirety or in part); but does not include any securities, a futures contract, any interest in a collective investment scheme, a structured product or an OTC derivative product as defined by the Securities and Futures Ordinance (Cap. 571); or a virtual asset.

The scope of the regime is not only limited to dealers who sell products in stores. Any person who engages in business activities such as buying, selling, exporting, or importing; manufacturing, refining, or value-added processing of precious metals, precious stones, or precious products; or redeeming or trading precious-asset-backed instruments, or acting as intermediaries in the aforementioned activities, are all considered dealers in precious metals and stones!

If you are involved in any of such business activities and intend to carry out transaction(s) with total value at or above HKD120,000, please register as soon as possible.

Difference between Category A and Category B Registration:

The registration regime for dealers in precious metals and stones is divided into the following two categories:

(a) Any dealer who intends to carry out non-cash transaction(s) with total value at or above HKD120,000 in the course of business must register as a Category A registrant.

(b) Any dealer who is seeking to engage in cash transactions with total value at or above HKD120,000 and non-cash transactions with total value at or above HKD120,000 in the course of business is required to register as a Category B registrant. Category B registrants are subject to anti-money laundering and counter-terrorist financing supervision.

For dealers who only carry out cash or non-cash transaction(s) with total value below HKD120,000, no registration is required.

Display of Registration Information

– Certificate of registration and branch certificates for branches carrying out face-to-face transactions will be issued to a registrant upon granting of registration. Registrants shall display the certificates in a conspicuous place at the related premises.

– If registrants operate their precious metals and stones business through electronic means (such as websites or social media platforms), they must also display the QR code or registration number provided by the Customs and Excise Department on the related electronic platforms.

Category B registrants must carry out customer due diligence measures and fulfill other relevant obligations

Category B registrant, when engages in any cash transaction(s) with total value at or above HKD120,000, is subject to the requirements of Schedule 2 of the Anti-Money Laundering and Counter-Terrorist Financing Ordinance (Cap. 615), such as customer due diligence and record keeping.

While carrying out customer due diligence measures, a Category B registrant must request and the customer should produce identification documents (e.g. Hong Kong Identity Card, passport or other travel document) for identification and verification of their identities. A copy of such identification document shall also be made and retained for record. The respective records shall be kept for at least five years after the transaction completed or the business relationship with a customer ended.

Register of Registrants

Any person may inspect the Register of Registrants and obtain information about the registrants by clicking the following link:

Register of Registrants: https://www.drs.customs.gov.hk/wsrh/001s0?request_locale=en

First Registration is Free of Charge

Precious metals and stone dealers who have been operating before 1 April 2023 must apply for application within the nine-month transitional period (i.e. 1 April to 31 December 2023) with waiver of first registration and relevant fees.

The transitional period is not applicable to any person who would start up a precious metals and stones business on or after 1 April 2023. Registration is required before they can carry out any transactions(s) with total value at or above HKD120,000 (cash or non-cash).

Learn more about the “Registration Regime for Dealers in Precious Metals and Stones”:

https://www.drs.customs.gov.hk

Source: The Standard